23rd April 2020

It takes more than just a great relationship to build a strong insurance brand

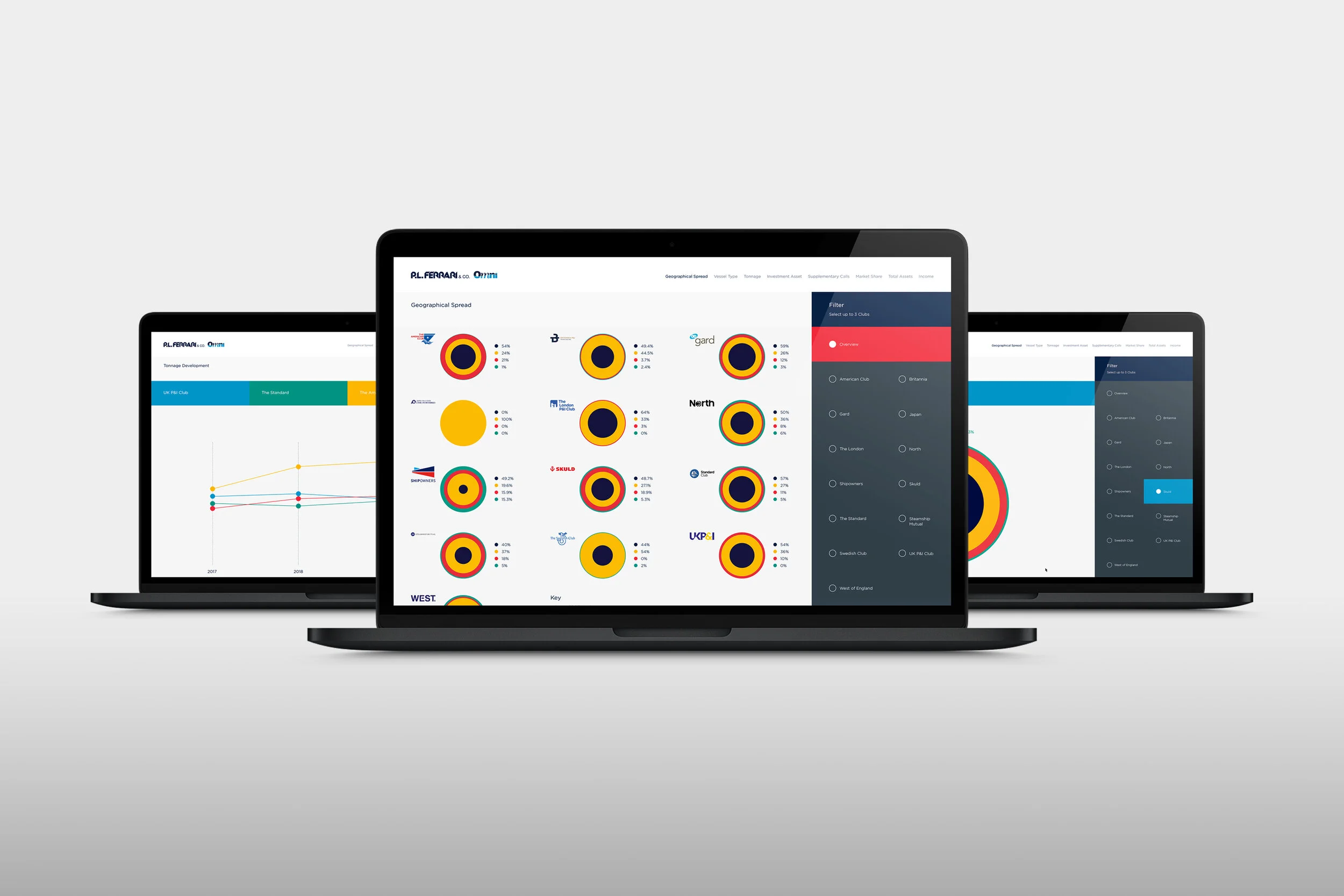

Illustration by Pangaea

The insurance business thrives on good, strong relationships which often transcend key individuals' moves from firm to firm. This is one factor which has contributed to the sector's resilience in tough times, and arguably its reluctance to embrace the kind of digital transformations that have disrupted other industries. However, we observe the winds of change.

Underwriting and the management of risk are changing quickly; artificial intelligence is turning hitherto advanced skills into commodities. Firms need – now more than ever – to seek other means of differentiation than price or efficiency or personal loyalties.

The creation of a strong brand is proven to drive success in just about every sector. A strong brand stands for something, a set of qualities, skills and values which, if intelligently and consistently articulated, can make all the difference in helping an organisation stand out.

In this blog, we’ll explore four key areas which insurance companies should be considering and reviewing regularly, with the view to galvanising and strengthening their brand:

1. Brand is more than a logo, it’s both a promise and an experience

2. Perception is reality, so make sure it is the right one

3. The value of values

4. Ensure the digital experience is as important as face to face

1. Brand is more than a logo, it’s both a promise and an experience

There are as many definitions of 'brand' as people you ask. But most experts agree that it's a combination of values, experiences and feelings which together create an expectation and make a promise. How we feel about brands depends on the clarity with which these values and promises are expressed through everything the brand does, where it does it, how much it charges us to experience it and the way it makes us feel while we're using it.

This is as much true for insurance services as it is for cars or soap powder. Maybe more so, because the experience is a human one and your people are (in part, at least) responsible for keeping the promises made by your brand. Traditionally in insurance, your word has been your brand. Which is why for us, creating a strong one which is authentic and representative of everything you stand for, is a more complex task than just creating a logo. Wouldn't you agree?

The winning approach is to engage target audiences with a consistent look, tone and feel both on and offline, with clear consideration as to how a brand identity comes to life beyond name and logo. When combined effectively, typography, colour palettes and imagery become powerful ownable tools to enhance and communicate your brand.

2. Perception is reality, so make sure it is the right one

Head and Shoulders told us in the 90's that 'you never get a second chance to make a first impression'. We'd argue that in this day and age, where digital media enjoys maybe one single second of our valuable attention, this rings even more true. Neuroscientists will tell us how we are ever more prone to snap judgements about brands as well as people, which means we need to make every impression count. A brand with a single second to communicate must make the most of it.

Strong brands have depth and meaning, authenticity and clarity which allow them to make that second last - in some cases for ever – because they promise long term relationships which mark them out from their peers. This is business-critical in sectors like insurance which are threatened by homogeneity – perceptually at least – which means that strong stand-out brands will prosper while the rest watch their margins erode with every passing year. In insurance, brands that use design to successfully demonstrate confidence and clear messaging, imply scale and robustness that creates reassurance and credibility.

There are internal benefits too: a strong brand attracts and helps to retain and reward the best people in the sector. This is this a competitive edge which you can measure in reduced HR costs.

3. The value of values

Ever seen a meaningless values statement? We've seen hundreds; and each has consolidated our clear point of view on values – the chances are you have a values statement which is bland, toothless, or just plain dishonest.

You might think they're harmless. We think quite the opposite. They're destructive.

Empty values statements create cynical and dispirited employees, alienate customers, and undermine managerial credibility. We think that's a shame… not just because the resulting cynicism poisons the cultural well but also because it wastes a great opportunity. Values can set a company apart from the competition by clarifying its identity and serving as a rallying point for employees.

Coming up with strong values—and sticking to them—requires real guts. When properly practiced, values inflict pain. They make some employees feel like they may be in the wrong place. They limit an organisation’s strategic and operational freedom and constrain the behaviour of its people. They leave you - the leaders - open to criticism for even minor violations. And they demand constant vigilance. If you’re not willing to work through the pain, then don’t bother with a values statement. But if you are, a whole host of exciting opportunities await.

4. Ensure the digital experience is as important as face to face

Our retail and consumer goods clients have invested a lot of time plotting customer journeys, trying with our help to see the friction points - the places along that journey where things become difficult, and customers drop out. Lately we've applied this process to our B2B clients, including the insurance sector. Our findings are predictable, and irritating.

We see a game of two halves; online and offline. The offline half is where the traditional business of building meaningful relationships is done. Some companies are great at this. Maybe you're one of them. But it's in the online half that a catalogue of basic errors are made in easing potential customers through their journey. We sum this up in one word: neglect. If in insurance we neglect to plot the customer journey with equal and consistent diligence both on- and off-line, you will lose customers without ever knowing they were in your pipeline at all. Successful companies – in insurance and other sectors – view this journey holistically and understand that the two halves exist not chronologically, nor exclusively, but symbiotically.

Summary

Human relationships still have an important role to play in the insurance sector but when supported by a strong brand there are significant opportunities to create something different. This difference is becoming more important as technology advances and helps to make hitherto essential human skills, more homogenous.

Time spent investing in your brand is time well spent and the return on investment is measurable.

A strong brand stands for something, a set of qualities, skills and values which, if intelligently and consistently articulated, can make all the difference in helping one organisation stand out against its peers.

Have any questions? Drop us a line at hello@pangaeacreative.co.uk

Pangaea is an independent design consultancy that grew out of Formula1. We thrived in this cutting edge, fast-moving environment and now bring our experience of designing in F1 to clients and brands seeking to gain an edge over their competitors in any market.